trust capital gains tax rate australia

The ATO has recently released two draft tax determinations TD 2016D4 and TD 2016D5. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

![]()

Capital Gains Tax Cgt Calculator For Australian Investors

What is the capital gains tax rate on a trust.

. Ad If you have a 500000 portfolio be prepared to have enough income for your retirement. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations.

Check if your assets are subject to CGT exempt or pre-date CGT. The tax-free allowance for trusts is. Will Wizard Australia Pty.

The only instance in which a family trust does pay tax is if the income isnt distributed to its beneficiaries. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. We expect these will underpin further audit activity around capital distributions from foreign trusts.

As part of the trusts net income or net loss the trust has to. In this case the trust gets taxed at the highest marginal tax rate. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

The ATO says that certain capital gains made by foreign trusts that are not taxed in Australia under the capital gains tax regime may be taxed in the. Contact Coral Gables Trust Attorneys. 2022 Long-Term Capital Gains Trust Tax Rates.

Capital gains of a trust are allocated to beneficiaries and the trustee in accordance with the rules in Subdivision 115-C of the ITAA 1997 which apply from the 2010-11 year. Download The 15-Minute Retirement Plan by Fisher Investments. Trust distribution to non-resident beneficiaries rules in the Income Tax Assessment Act 1936 ITAA 1936 ensure that a trustee is assessed on a non-resident trustee beneficiarys share of.

For more information please join us for an upcoming FREE webinar. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

Australia Corporation Capital Gains Tax Tables in 2022. The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates. For example the top.

CGT also applies to other assets including investment property but not your residence managed funds etc acquired after 19. Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250. What is the capital gains tax rate on a trust.

The trust deed defines income to include capital gains. You must then work out five-tenths of the capital gains tax which is 28125. By comparison a single investor pays 0 on capital gains if their taxable.

For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. If you have additional questions or concerns about capital gains. Namely the 50 CGT discount.

2022 Long-Term Capital Gains Trust Tax Rates.

State Street Hit With Million Dollar Money Laundering Fine Money Laundering Dollar Money National Australia Bank

Capital Gains Tax Cgt Calculator For Australian Investors

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Ratantata Tata Tatagroup Incometax Taxfiling Tax Latestnews Businessnews News Gstupdates Taxupdates Filing Taxes Tata Family Chartered Accountant

Accounting Chart Shows Balancing The Books And Accountant Stock Illustration Stock Illustration Royalty Free Illust Accounting Accounting Books Stock Photos

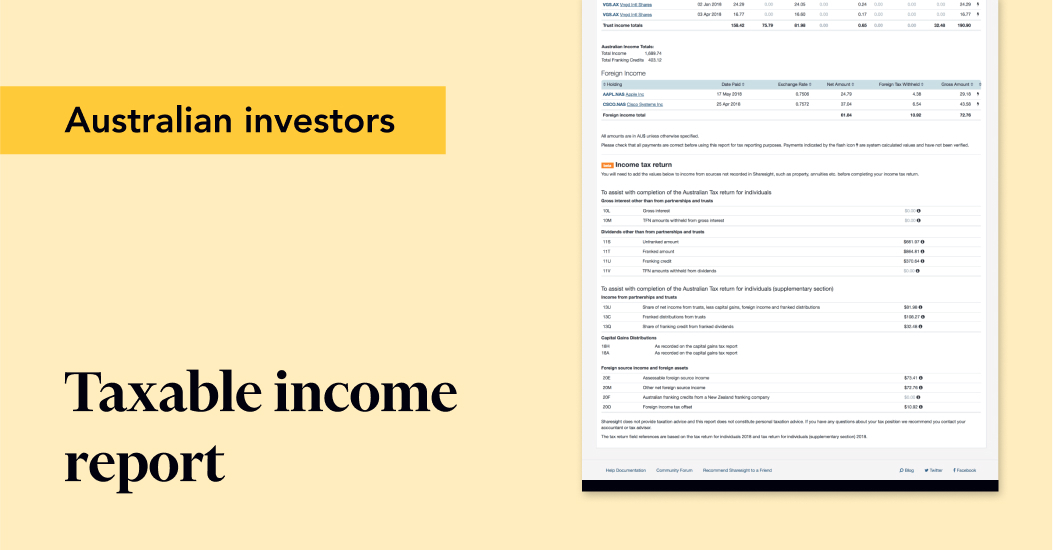

Taxable Income Report For Australian Investors

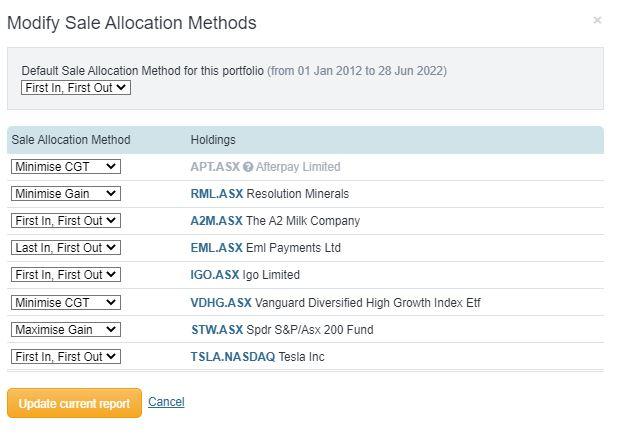

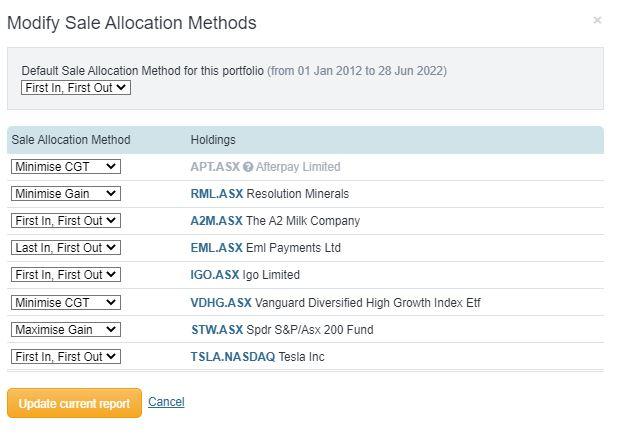

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains Tax Cgt Calculator For Australian Investors

What Are The Basic Tax Returns In Australia Tax Refund Income Tax Return Tax Return

Travel With The Best Rates In Town Melbourne Lkr 54 100 Onwards Call Student Hotline 0766399900 Travel Melbourne Student Travel September Travel Student

House Styles Around The World Real Estate Infographic House Styles Infographic

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Income Tax Return Filing Is Required For Every Individual Company Partnership Firm Trust And Every Oth Income Tax Return Filing Income Tax Return Tax Return

Modern Professional Looking Logo For An Accounting Business By Graphicsdreams Personal Logo Design Business Logo Design Logo Design